Vector Limited half year results out now - 28th February 2018

FINANCIAL RESULTS FOR THE SIX MONTHS TO 31 DECEMBER 2017

VECTOR EXPECTING A FLAT FY18 RESULT, IN LINE WITH PREVIOUS GUIDANCE

Financial Results Summary

Vector’s financial results for the half-year reflect its long-term investment in new energy future initiatives and the impact of Auckland growth on connections and capital expenditure.

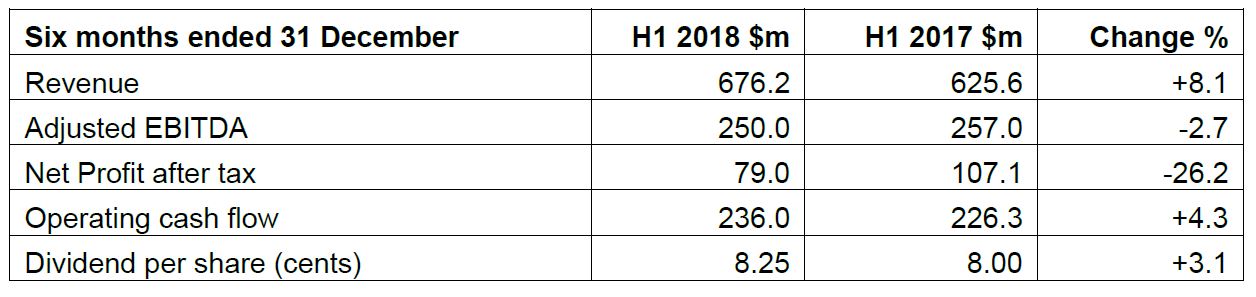

Revenue was up to $676.2 million from $625.6 million, due primarily to the acquisition of E-Co Products Group on 31 March. However, Group net profit was down to $79.0 million from $107.1 million in the prior period. This is largely because of one-off items totalling $18.8 million[1] in the prior year, as well as a significant increase in depreciation and amortisation in this half.

Adjusted earnings before interest, tax, depreciation and amortisation (Adjusted EBITDA) were down to $250.0 million from $257.0 million in the prior period. Regulated Business earnings were down $3.0 million largely due to an increase in maintenance expenditure. Gas Trading earnings were down $5.3 million, because of a $5.3 million insurance settlement one-off in the prior year, with underlying earnings flat.

While earnings in the Technology segment grew $4.2 million and helped to offset the earnings decline in Regulated Networks and Gas Trading, growth was lower than expected. The gains from acquisitions and the New Zealand smart meter roll-out were diluted by slow Australian meter deployment in advance of the Power of Choice reforms, by a lower than expected performance of E-Co Product Group’s heat-pump business, by the cost of establishing HRV Solar, and by changes to the way we account for internal communications services.

Capital expenditure (capex) increased 5.7% to $182.7 million from $172.9 million in the prior period. This was driven by Auckland growth and by higher network replacement capital expenditure, which was partly offset by lower metering capital expenditure in line with the slow-down in New Zealand meter deployment rates.

Creating long-term and sustainable value

Vector Chairman Michael Stiassny said, “The six months to 31 December 2017 saw continued progress towards Vector’s ambition of creating a new and more sustainable energy future.

“We believe the business is well positioned for the future. However, we were not satisfied with the slower than expected growth in our Technology part of the business. In particular, this was attributable to disappointing results in the E-Co Products Group’s heat pump business, as well as the cost of establishing the new HRV Solar business ahead of its recent launch in Auckland. In metering, installations in Australia were lower than hoped for as the market waited for the Power of Choice reforms to take effect in December 2017.

“In addition, there was increased planned and unplanned maintenance costs in our Regulated Networks business to accommodate Auckland’s continued rapid growth as well as the increased need to manage the vegetation risks to energy infrastructure.

“All these areas will be a key focus for the second half of the financial year. In a world being rapidly disrupted, we must maintain our focus on creating lasting and sustainable value for our customers, for shareholders and for New Zealand.

“According to the International Renewable Energy Agency (IRENA), by 2020, all the renewable power generation technologies that are now in commercial use will fall within the fossil fuel-fired cost range, with most at the lower end or even undercutting the cost of fossil fuels.

“Over the next decade, as the cost of solar and wind energy generation and battery storage inevitably falls and becomes competitive with traditional generation, we expect energy to be increasingly distributed, decentralised and democratised. Greater connectivity, artificial intelligence and data analytics will accelerate the adoption of the ‘internet of energy’, benefiting industries, communities, businesses, and individuals.

“Auckland is now one of the fastest growing cities in the western world, so energy infrastructure must accommodate this growth intelligently, reliably, sustainably, and cost-effectively. Customer expectations are changing too – in today’s world, we all expect continuous service and the ability to access what we want, when we want, and how we want.

“These are the mega trends we have observed in New Zealand and globally that have been driving our thinking as a business. And as has occurred in all other industries impacted by technological disruption, we believe these trends will give consumers more control and choice over the services they use and the way they use them.

“In December 2017, the Government outlined the draft terms of reference for the forthcoming review of retail electricity pricing in New Zealand, a review that Vector believes is timely. While the legacy generation and retail energy market framework has served New Zealand for some time, it may no longer be the best framework for a future where customers have more control over how, with whom, and when they use energy, where innovative companies may seek to enter the retail electricity market, where the impacts of climate change may impact the sector, and where technology can play a much greater role in enabling choice and control.”

Vector Group Chief Executive Simon Mackenzie said, “We are investing to facilitate this future in different ways. Through our network, using a mix of traditional infrastructure and emerging technologies to support Auckland’s needs now and into the future. Through smart metering to give consumers better information on their usage and enable retailers to innovate with new products and models. And through new energy technologies for residential and commercial customers via HRV and PowerSmart.

“In addition, our ambitions and presence are increasingly extending beyond New Zealand. Our smart meter business is well positioned in Australia and will be deploying smart meters for at least four leading Australian electricity retailers in 2018. PowerSmart is delivering the 5MW battery to Territory Generation in Alice Springs in the Northern Territory, and has been selected for a similar project in Niue in the South Pacific.

“A scenario is emerging where what is good for consumers is also good for our environment, for network resiliency, for Auckland and, ultimately, for New Zealand. It’s an elegant dynamic – the more energy generation becomes distributed, the more control shifts to the consumer, the more they can reduce their own costs, the more resilient the network system becomes and the more sustainable and less carbon intensive our energy supply becomes.

“Having a significantly greater number of renewable and localised electricity generation sources will also help address one of the most pressing issues we face as a nation. Increasingly, climate change is altering New Zealand weather patterns. This means we must factor an increase in the number of ‘1 in 100 year’ extreme weather events and an increase in the risk of drought, with the consequent impact on New Zealand’s lake levels, so critical to our energy supply.

“Electricity will play a key role in helping to shift New Zealand to a low carbon economy, and technology will be a critical enabler. The world-leading internet-of-energy capabilities of mPrest, the next big advancement in energy systems, allows us to manage energy systems in more sophisticated ways, using data analytics, machine learning and artificial intelligence to manage network systems more efficiently, dynamically shift demand and improve resilience - as well as put more power and control in the hands of consumers.

“To achieve our objectives, we must continue to take the lead on innovation as new energy technologies emerge and evolve. We must trial and invest in ways to manage Auckland’s future energy needs that reflect what customers will want tomorrow, not just today.

“As part of a wider multi-million-dollar energy efficient partnership with Auckland Council we launched Vector Lights in January 2018. It is a brilliant showcase for new energy solutions that is now lighting up Auckland’s Harbour Bridge using a combination of solar, battery, LED, and peer-to-peer technology, and is living proof that the new energy future is now possible.

Looking ahead

Mr Stiassny said, “For Vector, while we are not entirely satisfied with our half-year financial results, we have maintained good operational momentum towards our longer-term goals. We’ve introduced a number of new innovations. We’ve diversified the Group even further and explored new opportunities. We have positioned ourselves well in a number of new and emerging markets.

“Vector’s balance sheet remains strong, with gearing as at 31 December 2017 at 47.3%, up from 43.9% at the prior half-year. We’re proud of the fact that we have paid out almost $1.7 billion in dividends over the last 12 years and that we have added $2.2 billion in investments into electricity and gas networks over that same time.

“As flagged last year, the Board has been reviewing the company’s dividend policy and has now approved a new progressive policy. Vector will increase dividends by at least 0.25 cents per share annually provided the company has the financial capacity to do so. We will review this policy once the parameters for the 2020 electricity reset are established.

“In line with this policy, the directors have declared a dividend of 8.25 cents per share, up 0.25 cents on the prior year’s interim dividend of 8.0 cents per share. The record date for dividend entitlement is 28 March 2018 and the payment date is 11 April 2018.

“Looking ahead, we reaffirm our guidance from August 2017 for adjusted EBITDA for the full-year to 30 June 2018 to be at or around last year’s result.”